Retail Real Estate Firm Recognized for Marketing Expertise and Professional Excellence

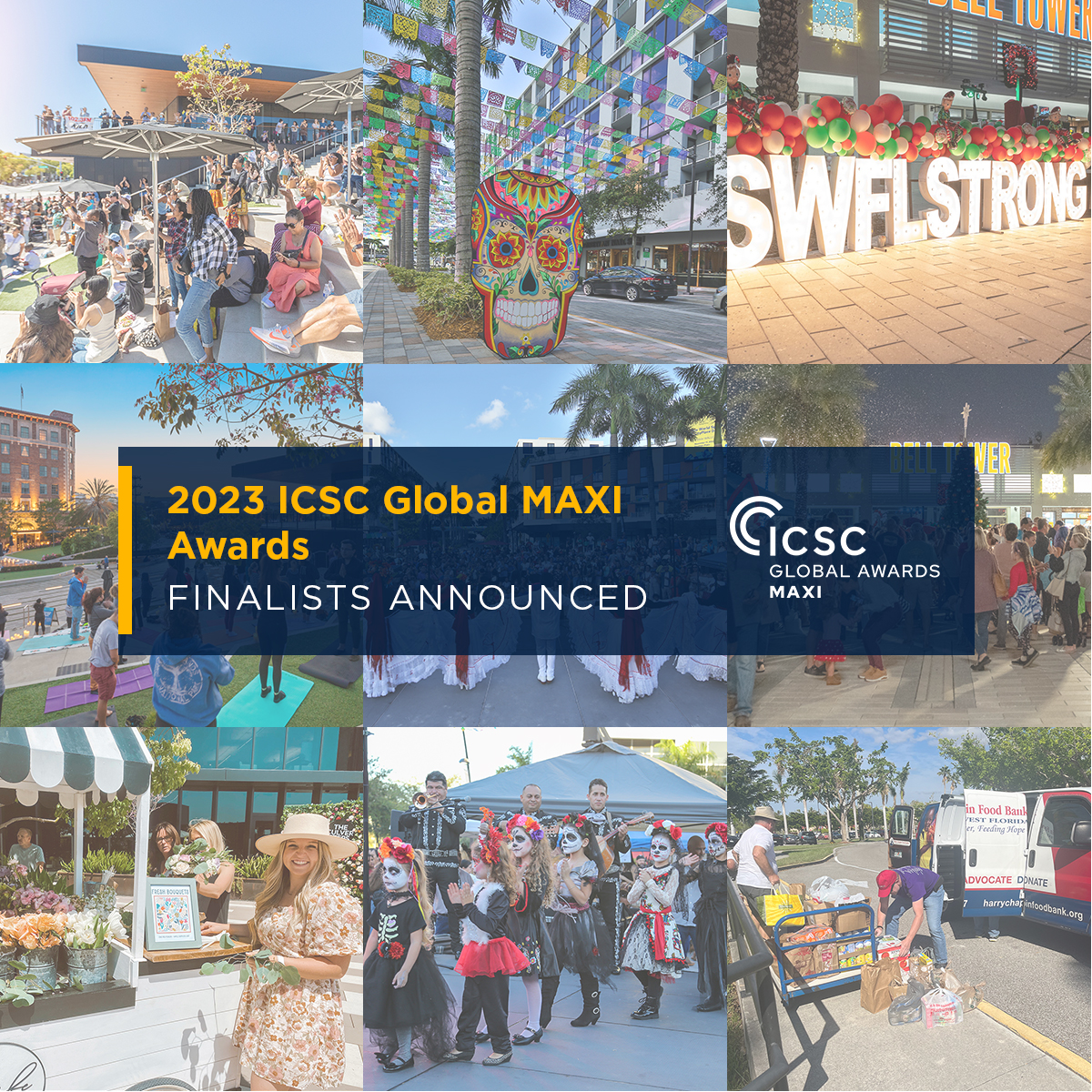

Washington, DC — March 31, 2023 — Madison Marquette, a leading private full-service real estate provider, investment manager, developer and operator, today announced that three of its properties have been named finalists for one of the coveted and highly competitive MAXI awards from ICSC. Winners are expected to be announced during the prestigious Global Awards Ceremony held during the ICSC Las Vegas conference in May. The MAXI Awards recognize innovative events, programs and technologies that add value to the retail real estate industry. Award categories are designed to recognize the evolution of the industry while rewarding creativity and innovation.

“We are both excited and honored to announce that three properties marketed by Madison Marquette have been named finalists in this year’s ICSC MAXI awards competition,” says Heather Almond, Executive Vice President, Retail Services, Madison Marquette. “These awards shine a light on the unique method Madison Marquette employs when analyzing industry data and trends and turning that information into actionable, results-oriented programs when promoting its tenants and marketing its shopping centers. This year’s MAXI awards are incredibly competitive with entrants representing shopping centers from around the world, and finalists like The Culver Steps, Bell Tower and CityPlace Doral represent the very best in retail real estate marketing expertise.”

2023 Finalists

Madison Marquette’s The Culver Steps, Bell Tower, and CityPlace Doral and have each been named a finalist in this year’s MAXI awards competition.

• The Culver Steps: “Integrated Marketing Brands The Culver Steps”: Finalist (Integrated Category) — As a public/private mixed-use property, The Culver Steps had focused primarily on B2B and leasing since its 2019 opening. When traffic and visitations stalled, the center’s owner wanted to host events to attract consumer attention. Maximizing its in-depth market research to create a year-long series of inspired events that would resonate with its target market, the center increased property visits by 60% YOY, increased traffic on Tuesdays, Wednesdays and Thursdays by up to 84%, added $20,112 in 2022 specialty leasing revenue, and filled 12,961 square feet of vacant space. An overhaul of its social media, PR and website messages earned 27,846,887 local consumer impressions and expanded the center’s trade area by 10.4%, while careful cost management yielded a 14% program ROI.

• Bell Tower: “SWFLStrong”: Finalist (Community Category) — Located in southwest Florida, Bell Tower was directly in the path of Hurricane Ian, the deadliest storm to hit Florida since 1935. With thousands of its shoppers now homeless, mountains of soggy furniture lining the streets, bridges and roadways destroyed, and the area’s beautiful landscape buried under piles of rubble, Bell Tower created #SWFLSTRONG to provide food and other essential products and services to area residents; it also moved seven displaced businesses to the center. Using just 6% of its 2022 marketing budget, it increased event traffic up to 23% and individual merchant sales by as much as 30% YOY while creating a sense of normalcy and inspiring hope throughout the community.

• CityPlace Doral: “Cultural Experience Changes Perceptions”: Finalist (Experiential Category) — For years, CityPlace Doral’s merchandising concentrated heavily on its nightlife and clubs. Over time, this negatively impacted the perception of the center and alienated family shoppers in the center’s primarily Hispanic demographic. To combat this, Madison Marquette relied on its proprietary methods for analyzing market data to support the center’s management team and create a multi-week program featuring two culturally significant events – Kiddoween and Day of the Dead – to increase traffic and sales, but more importantly, attract Hispanic families before the holiday season. Through promotional efforts, the center generated 116,576,661 impressions in the targeted Hispanic market, and while using just 6.62% of its 2022 marketing budget, via partnerships, offset costs by $45,450.

About Madison Marquette

Madison Marquette is a real estate investment and service firm with a national platform that transforms assets and delivers institutional quality results. The cornerstone of our talents and abilities is identifying market opportunities, repurposing great assets and creating places that thrive as destinations. Our proven track record over three decades and over $6 billion in investments has earned us a reputation as a leading operator and investor in multiple property types including mixed-use retail, office, multifamily, senior housing, and medical office Learn more at www.development.madisonmarquette.com.

Media Contact:

Deborah Blackford, Blackford & Associates

714.280.8765

WASHINGTON — Madison Marquette, a leading private real estate service provider, operator and developer, is pleased to announce Jon Carrasco as Associate Director, Research and Data Analytics for Madison Marquette. In this role, Mr. Carrasco will be responsible for supporting the company's national brokerage platform by providing market intelligence, strategic analytical tools, and insight interpretation that will position the company to deliver more effective, competitive, and successful intelligence and analytics to its clients. He will report to the National Director of Research and senior market leadership to develop and execute strategic research plans to align with Madison's goals for expanding and improving its Research & Data Analytics platform.

WASHINGTON — Madison Marquette, a leading private real estate service provider, operator and developer, is pleased to announce Jon Carrasco as Associate Director, Research and Data Analytics for Madison Marquette. In this role, Mr. Carrasco will be responsible for supporting the company's national brokerage platform by providing market intelligence, strategic analytical tools, and insight interpretation that will position the company to deliver more effective, competitive, and successful intelligence and analytics to its clients. He will report to the National Director of Research and senior market leadership to develop and execute strategic research plans to align with Madison's goals for expanding and improving its Research & Data Analytics platform.

the property's existing tenants identifying strategies to maximize sales performance, ensuring the full integration of activation, leasing and operations at the property.

the property's existing tenants identifying strategies to maximize sales performance, ensuring the full integration of activation, leasing and operations at the property.

more contemporary mix of better priced emerging and established lifestyle retail and services brands, as well as destination dining and entertainment tenants. The re-leasing effort will result in a new mix of tenants in over 50% of the project's gross leasable area.

more contemporary mix of better priced emerging and established lifestyle retail and services brands, as well as destination dining and entertainment tenants. The re-leasing effort will result in a new mix of tenants in over 50% of the project's gross leasable area.